Tax system of Ukraine: corporate income tax and simplified tax system

1. Overview

2. Simplified tax system in Ukraine

3. Corporate income tax

One of the most important aspects that foreign investors focus on when considering Ukraine as a place for doing business, despite the economic situation in the country, is taxation. It is the amount of tax payments, as well as the tax administration complexity, that can greatly affect the country’s investment attractiveness. The most significant taxes to be taken into consideration by potential investors in Ukraine are corporate income tax, value-added tax, single social contribution, and property tax.

To create favourable conditions for attracting significant investments to Ukraine, the Law “On State Support of Investment Projects with Significant Investments in Ukraine” came into force on 13 February 2021 (these are investment projects exceeding the amount equivalent to EUR 20 million). This Law provides for state support amounted up to 30% of the budgeted amount of significant investments (specified in a special investment contract) for the implementation of such an investment project in Ukraine. In particular, state support for large investors may be provided in the form of:

- exemption from income tax for 5 years;

- exemption from import duty and value-added tax of new equipment and its components imported for the investment project to be implemented;

- reduction of land tax and rent rates for state and communal lands or exemption from land tax.

Simplified tax system in Ukraine

It should be noted that in addition to the general tax system providing for the payment of all taxes and duties established by law, businesses in Ukraine can also benefit from the simplified tax system in Ukraine intended to facilitate the development of small and medium-sized enterprises, since it significantly simplifies the procedure for paying taxes and declaring income.

An individual or a legal entity, including non-residents, may choose to benefit from the simplified tax system if they meet the criteria established by law. For instance, the third group of the simplified tax system, which is the most popular among legal entities, may be used if the annual turnover of such a legal entity does not exceed 1,167 minimum wages fixed by law on 1 January of the tax (reporting) year (about UAH 7 million, an equivalent to about EUR 210,000) per year. If this basic requirement is fulfilled, the respective business entity may use a flat rate of 5% of income if the value-added tax is included in the single tax or a flat rate of 3% of income if the business entity is a value-added tax payer. Paying a single tax makes it much easier to declare and administer income, which often attracts business in its early stages.

The fourth group of the simplified tax system establishing special taxation conditions for agricultural commodity producers might also be interesting for foreign investors. In this case, the tax rate depends on the land category, its location and area. Legal entities are entitled to choose the fourth group of the simplified tax system provided that their agricultural commodity production share is equal to or exceeds 75% for the previous tax (reporting) year. This is applicable to:

- legal entities created by merger or accession. In this case, it is possible to become a single tax payer in the year of creation, if the agricultural commodity production share received for the previous tax year by all individual members involved in such a reorganization equals to or exceeds 75%;

- each individual entity created by split-up or spin-off. In this case, it is possible to become a single tax payer from the next year if the agricultural commodity production share for the previous tax year equals to or exceeds 75%;

- an entity created by transformation. In this case, it is possible to become a single tax payer in the year of transformation if the agricultural commodity production share obtained for the previous tax (reporting) year equals to or exceeds 75%.

Newly created agricultural commodity producers (legal entities) may become single tax payers from the next year if the agricultural commodity production share for the previous tax year equals to or exceeds 75%, and newly created agricultural commodity producers (individuals) from the year of their state registration.

Thus, single tax payers are exempt from the obligation to charge, pay and file the respective tax reports regarding taxes and duties such as corporate income tax, value-added tax, property tax, and partially subsoil use tax. Let’s review the conditions of income tax payment in detail.

Corporate income tax

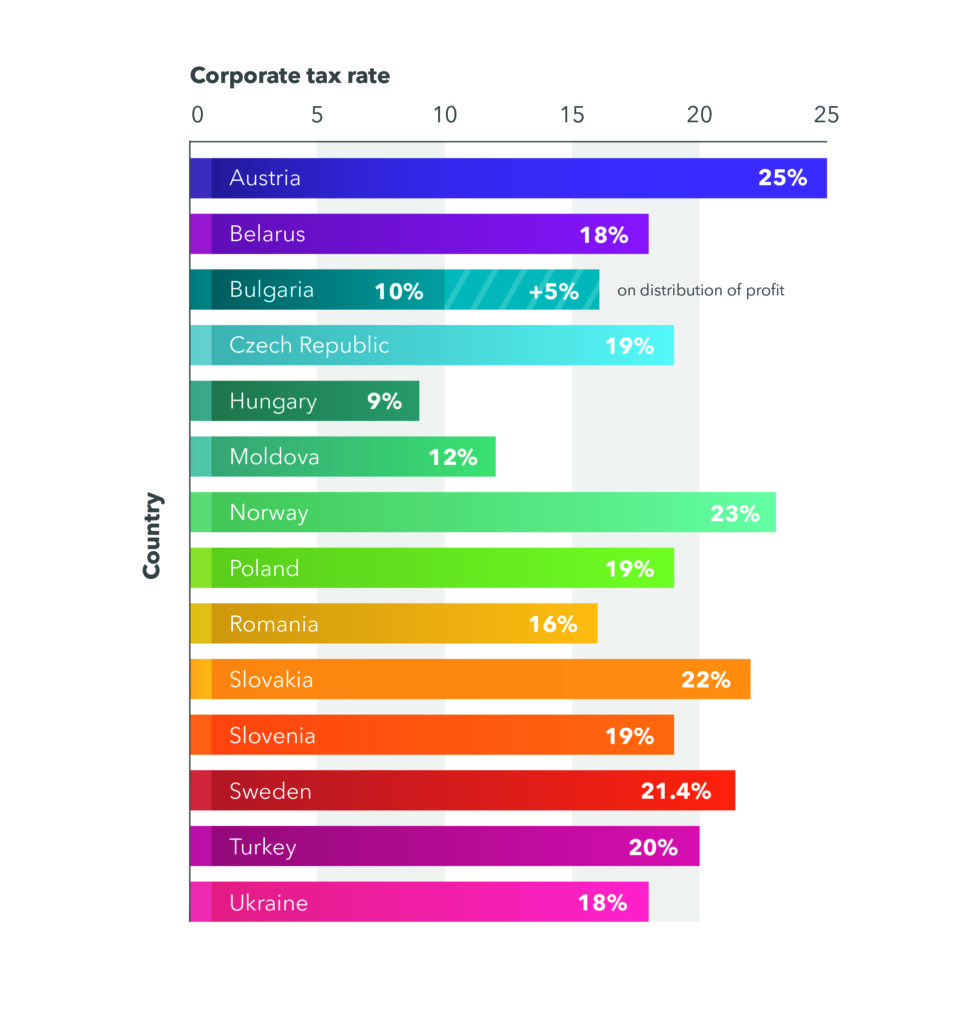

Corporate income tax rate across different countries

Currently, a reference (basic) rate of 18% is established for all corporate income tax (CIT) payers. However, for some activities, a separate rate shall apply. Income of non-residents from certain transactions is taxed at a rate of 15%, the freight amount paid to a non-resident by a resident is taxed at a rate of 6%.

CIT is paid by the resident companies, receiving income both in Ukraine and abroad. CIT is also paid by the non-resident companies created in any form of business organization and receiving income from Ukrainian sources, and non-residents operating in Ukraine through a permanent representation and/or receiving income from Ukrainian sources, and other non-residents obliged to pay income tax.

The CIT base is the income derived from Ukrainian and foreign sources of origin. The amount of income is determined by adjustment (increase or decrease) of financial result before tax (profit or loss) defined in the enterprise’s financial statements in accordance with the Ukrainian accounting standards or IFRS, on the differences arising under the provisions of the Tax Code of Ukraine.

Starting from 1 January 2021, non-resident companies operating in Ukraine through separate divisions, including permanent representations, are required to register with regulatory authorities within 3 months. Incomes of non-residents operating in Ukraine through a permanent representation are taxable on general terms. For the purposes of taxation, such a permanent representation is equated to a taxpayer performing its business independently of a respective non-resident. Permanent representations of non-residents that were registered as taxpayers (including corporate income tax) before 1 January 2021, remain to be the payers of such taxes until registration as taxpayers (including corporate income tax) of the respective non-residents.

For a more extensive overview of the tax system in Ukraine, please check our brochure below: