Tax system of Ukraine: VAT, single social contribution and property tax

Value-added tax in Ukraine

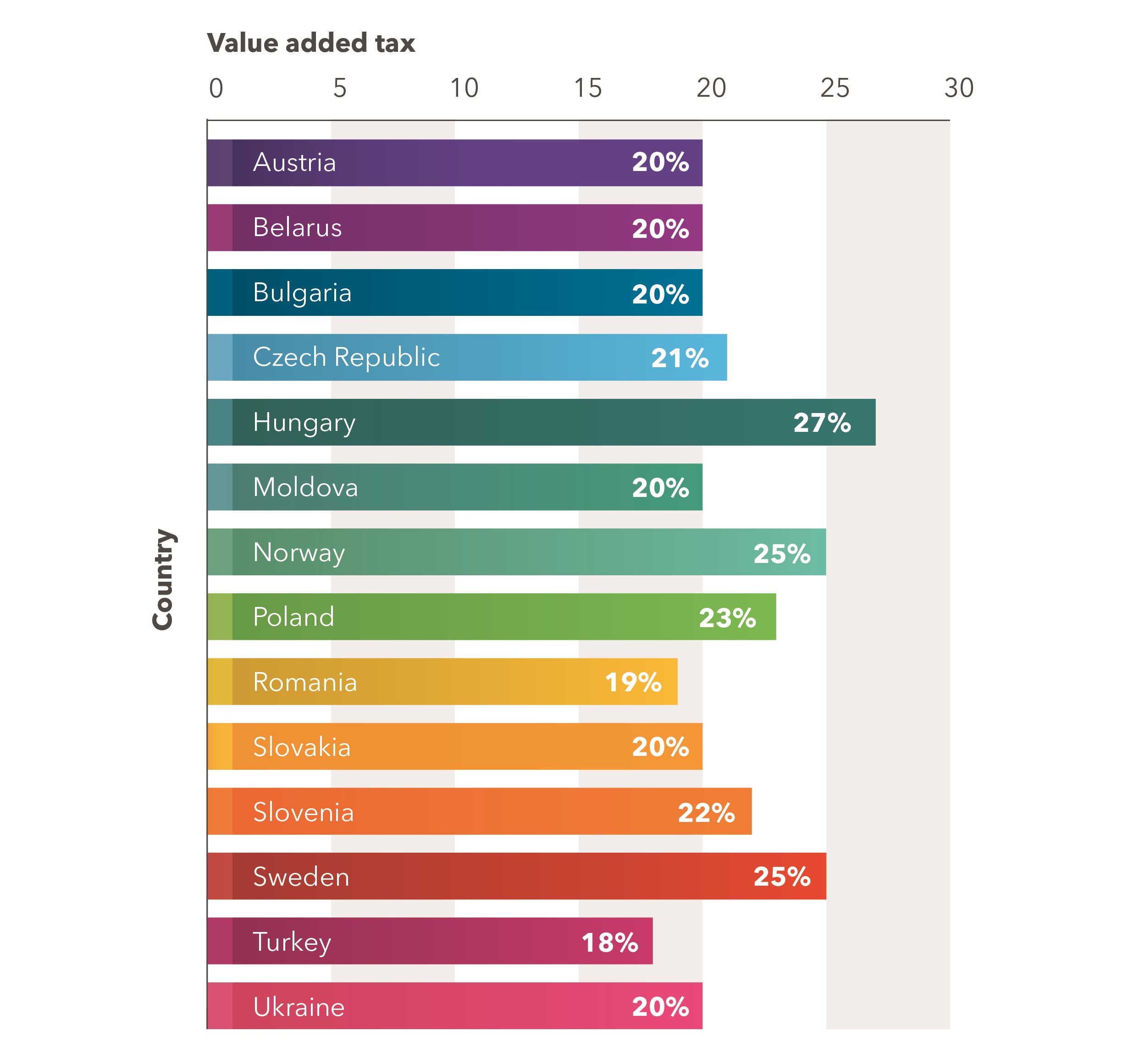

The value-added tax (VAT) rate is 20%. For pharmaceutical products, the VAT rate is 7%. It should be noted that 0% VAT rate is applied to export of goods in the customs regime from the territory of Ukraine.

The taxpayer is obliged to register as a VAT payer if the aggregate value of supplied goods or services exceeds UAH 1 million for the last 12 months. However, if the value of taxable transactions does not exceed UAH 1 million, the voluntary registration as a VAT payer is available.

VAT is applied to transactions on supply of goods and services on the custom territory of Ukraine, as well as to transactions related to import and export of goods in Ukraine. In addition, services on international transportation of passengers and luggage by sea, river and air transport are also subject to VAT.

The chart below shows the VAT across a range of countries.

Single social contribution and military duty

The single social contribution is paid by employers, private entrepreneurs, and self-employed citizens. The single social contribution rate is established at 22%. However, the maximum taxable amount of the single social contribution shall not exceed 15 minimal wages.

The military duty has been made effective in Ukraine for several years now and amounts to 1.5%.

Property tax

The property tax is paid for real estate and movable property. The real estate tax on buildings and land plots is paid by individuals and legal entities, including non-residents.

The amount of real estate tax on buildings is determined by the municipal authorities. However, the tax rate shall not exceed 1.5% of the minimal wage per 1 sq. m. of residential and non-residential property.

The additional tax rate in the amount of UAH 25,000 is applied to apartments of more than 300 square meters and houses of more than 500 square meters.

The real estate tax is paid per each sq. m. of residential and non-residential property. Owners of apartments of less than 60 sq. m. and houses less than 120 sq. m. (or houses and apartments with a total area of 180 sq. m.) are exempt from tax.

The amount of real estate tax on land plots is determined by the municipal authorities. The rate shall not exceed 3% of the normative evaluation of a land plot and 1% for agricultural land plots of general use. For farmland, the rate shall be not less than 0.3% and not more than 1% of its normative evaluation. For forest lands, the rate shall not exceed 0.1% of their normative evaluation. For land plots, which are under permanent use by business entities, the rate shall not exceed 12% of the normative evaluation.

The tax base is land plots in ownership or use.

Please also check our article on corporate income tax and the simplified tax system.

For a more detailed overview of the Ukrainian tax system, check our guide below: