6 steps for foreigners to buy real estate in Ukraine

Ukrainian laws impose almost no restrictions on acquisition of real estate in Ukraine by foreigners. Foreign nationals are entitled to dispose of the acquired real estate at their own discretion: to use, to lease, to give as a gift, to exchange, to sell, to pledge, to contribute to the authorized capital and to bequest it.

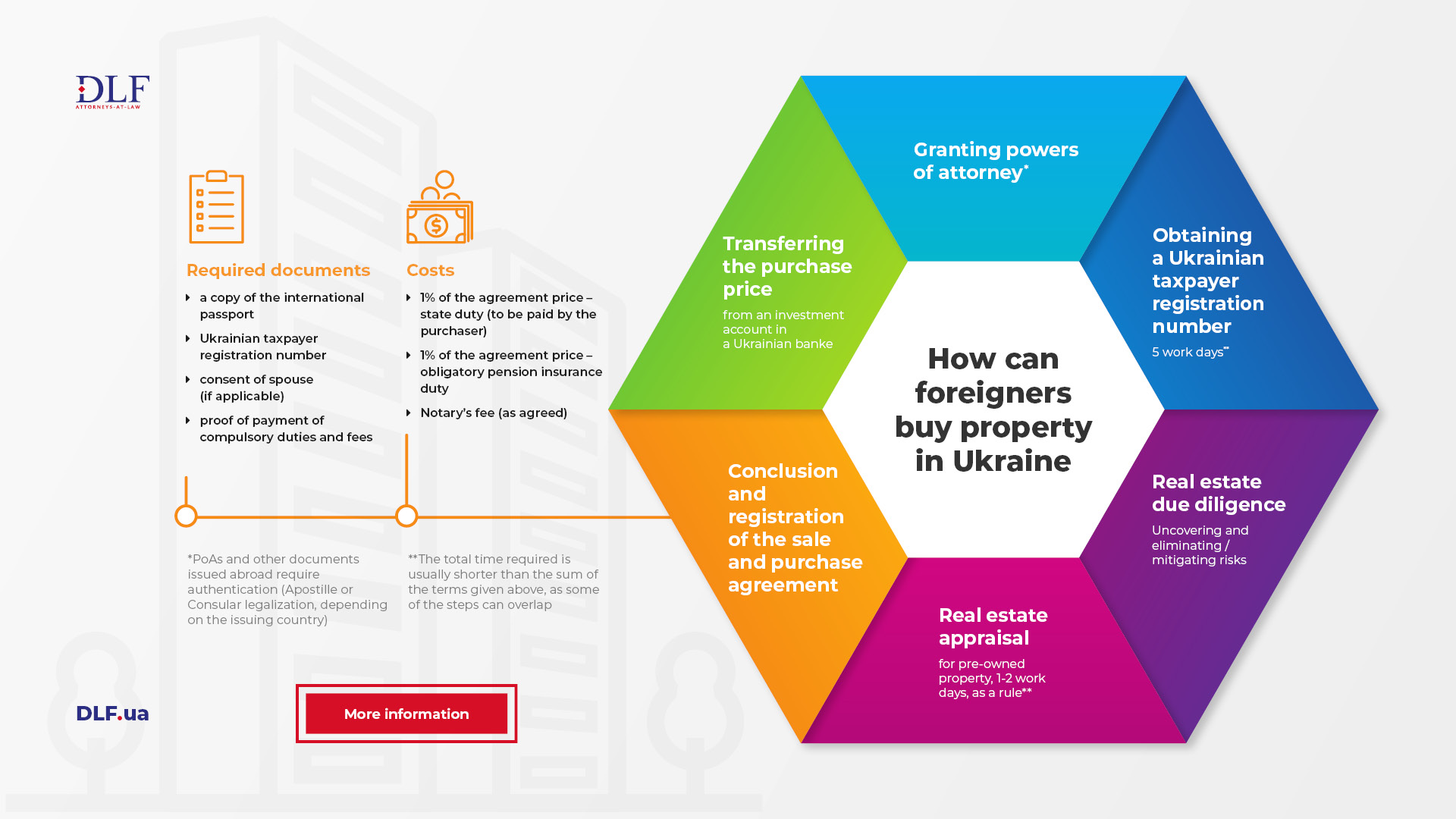

The procedure for acquisition of real property in Ukraine by a foreign national can be divided into 6 simple steps:

1. Granting powers of attorney

2. Obtaining a Ukrainian taxpayer registration number

3. Real estate due diligence

4. Real estate appraisal

5. Conclusion of the agreement and registration procedure

6. Payment for purchase

1. Granting powers of attorney

All the actions enumerated below, especially signing a sale and purchase agreement, opening an investment account, making all necessary payments in Ukraine etc., can be personally taken by a foreign national or his/her authorized attorney on a basis of a power of attorney. This implies that all the actions can be taken by a lawyer.

(Click on the image for full view)

A power of attorney can be granted both in Ukraine and abroad. PoAs and other documents issued abroad require authentication (Apostil or Consular legalization, depending on the issuing country).

2. Obtaining a Ukrainian taxpayer registration number

In order to acquire real property in Ukraine, the foreign national (or its representative acting on the PoA) has to obtain a Ukrainian taxpayer registration number.

The procedure for obtaining the registration number is simple: submitting to the appropriate body of the Ukrainian Fiscal Service the application with personal information along with the notarized translation of the foreign national’s passport. The issuance of the taxpayer registration number takes 5 business days.

3. Real estate due diligence

When acquiring real estate, a special consideration must be given to the peculiarities of acquisition of real estate on the primary market (acquisition from the developer or investment in construction) and on the secondary market of real estate (a purchase from the former owner).

An apartment being acquired on the secondary real estate market can be vulnerable to potential risks, which can be carefully identified as well as eliminated/minimized through a due diligence examination. Such an examination carried out in a proper way allows to avoid all hidden pitfalls.

In general, it should be noted that the purchase of a new construction apartment in Ukraine involves certain risks, e.g. availability of developer’s permits or its reputation, which have to be thoroughly analyzed by the lawyers before signing the sale and purchase agreement.

4. Real estate appraisal

When buying pre-owned real estate, appraisal of the given property has to be carried out. This normally takes 1-2 work days.

5. Conclusion of the agreement and registration procedure

Registration and notarization of a real estate sale and purchase agreement is performed by a Ukrainian notary. At the time of registration of the sale and purchase agreement, the notary also registers the transfer of the title to the real property.

When registering the above mentioned, the notary has to verify payment of all necessary duties and fees, authorization of the parties to conclude the legal transaction, and absence of encumbrances on the real estate.

Required documents

Generally, the following documents are essential for a real estate property to be acquired and officially registered in Ukraine by a foreign national:

– foreign national’s international passport, translated into Ukrainian;

– Ukrainian taxpayer registration number;

– consent of his/her spouse; that applies to married foreign nationals. Such a permission can be granted both in Ukraine and abroad; the latter needs notarizing and apostilling;

– proof of payment of compulsory duties and fees.

Costs

Registration of a real property sale and purchase agreement entails costs as follows:

- 1% of the agreement price – a state duty (to be paid by the purchaser),

- 1% of the agreement price – an obligatory pension insurance duty (to be paid by the Ukrainian seller, but often paid by the purchaser),

- notary costs (as agreed).

Costs relating to the purchase of a new construction apartment (taxes, registration fees, etc.), depend on the structure of the sale proposed by the developer in each particular case.

6. Payment for purchase

In order to pay for purchase of a selected real property, a foreign national has to open an investment account in a Ukrainian bank. The following procedure has proved successful (especially given that a foreign national intends to sell his/her Ukrainian real property in times to come):

– transferring to this investment account the foreign currency from abroad;

– selling the foreign currency to Ukrainian currency (for further implementing the foreign investment);

– transferring from his/her own investment account funds in Ukrainian currency to the current account of the Ukrainian seller.

Payment for the real estate purchase, including transferring money to Ukraine and transfer verification performed by the Ukrainian bank, takes 3 to 6 work days.

Note! Due to the requirements of the national and international legislation, the above-mentioned conditions and timeframe regarding the opening of an investment account and money transfer might be different for citizens of the USA.

Miscellaneous

Note! The total time period for the purchase of real estate is usually shorter than the sum of the timeframes given above, as the steps do not have to be taken consequently and some of them can overlap.

The information on real estate purchase by foreign nationals provided above largely applies to property acquisition by legal entities as well. However, it should be noted that there are some peculiarities in the latter case. In particular, instead of obtaining a taxpayer registration number, the legal entity would have to register with the relevant tax authority. And the documents required would include an effective trade register excerpt (instead of a passport).

Another point worth mentioning is that when acquiring real property in the form of a separate building (such as a cottage), a foreign national may, along with the title to the building, acquire the title to the land plot where the building is located.