Insurance agreement in Ukraine: subrogation

Introduction

1. What is subrogation and how does it work?

2. Legal nature of subrogation

3. Peculiarities of subrogation in Ukraine

3.1. The right to subrogation is not the right to exercise it

3.2. Recovering damages from a causer

3.3. Subrogation under the general rule

3.4. Insurance indemnity does not equal compensation for damages

3.5. When the insurance amount is paid to another beneficiary

4. Effective use of subrogation

Subrogation is an important mechanism for efficient operation of insurance companies. It allows insurance companies to recover part of their expenses related to insurance claims. Such expenses may be assigned to a person responsible for the occurrence of an insured event.

In Ukraine, subrogation is currently used to a limited extent. Insurance companies mainly use this mechanism in motor insurance. This is due to both the lack of legal regulation and systematic application practice.

At the same time, effective application of subrogation in commercial insurance may provide an incentive for Ukrainian insurance companies to expand the range of riskier insurance operations and encourage businesses to make bolder investments and earn higher profits.

Successful use of subrogation mechanisms could also be crucial for the implementation of a wartime risk insurance system. The Ukrainian economy is in need of investment, but the concerns of investors and insurance companies are understandable. The prospect of reimbursement of insurance payments at the expense of the aggressor country as the culprit of wartime insured events may motivate insurance companies to insure such risks in commercial and investment transactions. Under such conditions, investment in Ukraine has a chance to grow exponentially.

1. What is subrogation and how does it work?

Subrogation is a term that describes the right of an insurer to seek reimbursement of the sum insured from the person who caused the insured event. Subrogation literally means an action by the insurer that results in it taking the place of the insured in relations with the person who caused the insured damage.

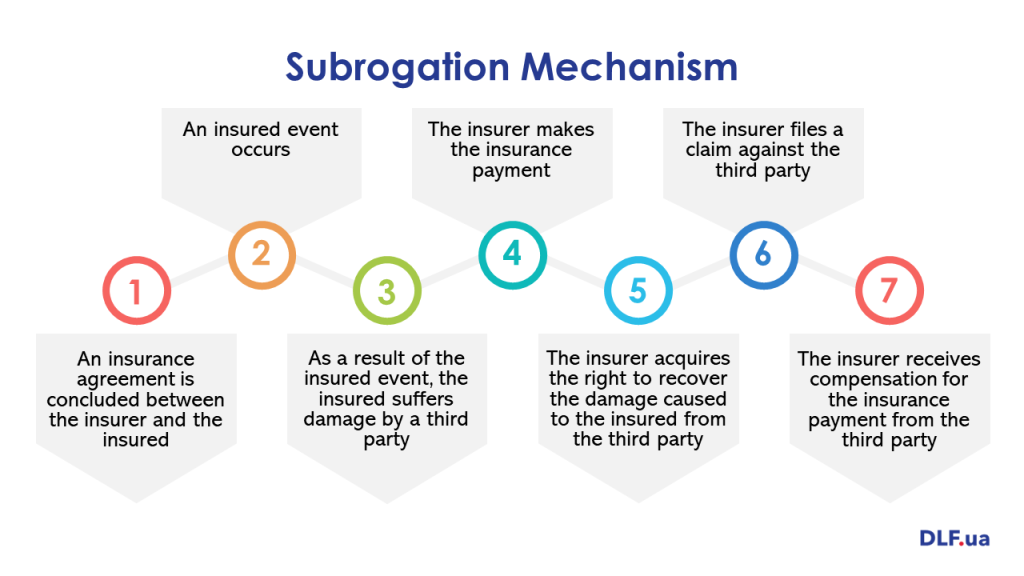

In general, the mechanism of subrogation is as follows:

2. Legal nature of subrogation

The main characteristic feature of subrogation is that the obligation, existing at the time of the damage and in connection with which the insurance indemnity was paid, is preserved, as well as the change of the creditor. No new obligation arises under subrogation. In the legal relationship of damage compensation, the right of claim is transferred from the insured to the insurer.

The insurer (as the new creditor) acquires the rights of the insured (as the original creditor) to the compensation for damage to the extent and on the terms and conditions that existed at the time of the transfer of these rights.

Subrogation is very similar to recourse from a legal point of view, as in both cases there is a counterclaim. However, the Ukrainian court practice of recent years allows to distinguish between these legal categories not only in general, but also in insurance relations, namely:

3. Peculiarities of subrogation in Ukraine

In Ukraine, subrogation is a special legal mechanism used in insurance relations that has a number of peculiarities, namely:

- subrogation is applied by insurers, i.e., companies licensed to carry out insurance activities;

- subrogation is applied if there is an insurance contract between the insurer and the insured;

- subrogation transfers to the insurer the right to claim for damage caused as a result of an insured event;

- subrogation may not be applied if the damage caused does not depend on the actions of third parties (for example, loss of property as a result of a natural disaster) or is not a consequence of an insured event;

- the insured (or other person who has received the insurance indemnity) must have a valid claim against the person causing the damage at the time of payment;

- by way of subrogation, the insurer may make a claim against the insured only in the amount of the insurance indemnity paid to the insured;

- by way of subrogation, the right of claim against the causer of damage is transferred to the insurer on the basis of law (automatically);

- by way of subrogation, the right of claim against the person having caused the damage is transferred to the insurer from the moment the insurer pays the insurance indemnity to the insured;

- the limitation period for claims for damages under subrogation in Ukraine commences from the date of the insured event.

In practice, based on the above peculiarities, insurers should take into account certain specifics when applying subrogation in Ukraine (discussed below).

3.1. The right to subrogation is not the right to exercise it

The right to subrogation does not mean the right to exercise subrogation

A distinction should be made between the right to subrogation and the right to exercise subrogation. The right to subrogation arises from the moment the insurer enters into an insurance contract, while the right to exercise subrogation arises after the insurer pays the insurance indemnity to the insured.

The insurer has the right to subrogation from the moment it enters into an insurance contract with the insured. However, it can only exercise this right (e.g., file a lawsuit against the person responsible for the damage) after paying the insurance indemnity to the insured. This means that the mere existence of an insurance contract, the occurrence of an insured event and the insurer’s obligation to pay the insurance indemnity to the insured does not entitle the insurer to file a claim for damages against the causer of the damage.

From a legal point of view, the change of creditor by way of subrogation occurs at the time of payment of the insurance indemnity. Prior to that, it is the insured who has the right to recover the damage from the causer.

3.2. Recovering damages from a causer

By way of subrogation, the insurer may recover from the loss causer only the amount that the insurer will pay to the insured

The payment of insurance indemnity does not always fully compensate the insured for the losses incurred. This may be due to special insurance conditions (e.g., unconditional franchise or payment of insurance indemnity adjusted for property depreciation).

If the insurance indemnity only partially covers the damage caused to the insured, then two rights of claim will exist simultaneously against the damage causer:

- the first claim is the insurer’s claim in the amount of the insurance indemnity paid to the victim;

- the second claim is that of the insured in the amount of the part of the damage caused to him/her that was not covered by the insurance indemnity.

For example, in a property insurance contract with an unconditional franchise, the insurer, by paying the insurance indemnity reduced by the unconditional franchise, obtains the right to claim against the damage causer under subrogation to the extent of the paid amount. In its turn, the insured reserves the right to recover the amount of the deductible (or other difference between the amount of the insurance indemnity paid and the amount of actual damage) from the causer of damage.

3.3. Subrogation under the general rule

Under the general rule, subrogation does not require separate formalisation

Under the general rule set out in Article 993 of the Civil Code of Ukraine, subrogation (transfer) of creditor’s rights to the debtor responsible for causing losses to the insurer is based on the law. In fact, the transfer of the right to file a claim against the damage-causer to the insurer is not conditioned on the conclusion of any special documents (agreements, letters, orders). In other words, such a transfer is provided for by the Ukrainian legislator automatically.

Under the general rule, there is no need to draw up any subrogation receipts or agreements on the transfer of the right of claim, although this is not prohibited by Ukrainian law. However, it should be noted that it is not the fact of the transfer of the right of claim that requires registration. At the same time, the process of ensuring this process (transfer of documents, the insured’s obligation to transfer such documents, determination of the procedure, content and form of documents and information required by the insurer to exercise its right of subrogation) certainly requires detailed regulation by the parties.

3.4. Insurance indemnity does not equal compensation for damages

Payment of the insurance indemnity by the insurer to the insured does not terminate the obligation to compensate for damage and cannot be considered compensation for damage to the insured

In the legal relations of voluntary property insurance, the insurer is not a debtor in the obligation to compensate for damage. It pays the insurance indemnity based on a separate insurance contract. In other words, the damage causer remains obliged to compensate for the damage inflicted regardless of whether the insurance indemnity has been paid to the insured or not.

3.5. When the insurance amount is paid to another beneficiary

Subrogation also occurs when the insured amount is paid to a beneficiary other than the insured

Ukrainian law does not specify to whom the insurance indemnity must be paid for the insurer to have the right to subrogation. In particular, Article 979 of the Civil Code of Ukraine provides that under an insurance contract, in case of an insured event, the insurer undertakes to pay the insurance amount to the insured or another person specified in the contract.

However, in such cases, the person to whom the insurance payment will be made must have a right of claim against the damage causer. Otherwise, he or she will have nothing to transfer to the insurer by way of subrogation. Therefore, before paying insurance indemnity to a person other than the insured, the insurer must make sure that this person can properly confirm his/her right to claim compensation for damage caused as a result of the insured event.

4. Effective use of subrogation

In Ukraine, subrogation is an immensely promising mechanism for the insurance business. However, the peculiarities of legislative regulation and application practice necessitate certain steps, namely:

- examining the attributes of potential damage claims that may be related to an insured event. It is necessary to take into account the peculiarities of an insured object and the legal characteristics of claims that the insured may have against third parties in the event of, for instance, destruction of such an object. At a minimum, the insured must have the grounds for making a claim (e.g., provisions of an agreement for the delivery of the insured property). In addition, the insured must have a potential procedural opportunity to exercise such a claim;

- detailed regulation of the insured’s obligations to provide the insurer with all documents necessary to exercise subrogation (evidence, information on the circumstances of the insured event, contracts with the loss causer, etc.) in the insurance contract and insurance rules. It is not enough to simply stipulate the possibility of subrogation in the insurance agreement or insurance terms and conditions (this is already provided for by law). It is necessary to establish the timeframes for providing documents and information, their form and content, and the obligation to provide information required by the insurer during the recovery procedures;

- envisaging clear procedures in the insurer’s internal policies and insurance terms and conditions that would make it impossible to pay insurance indemnity without obtaining all the documents required for subrogation.

Following these recommendations will allow insurance companies to effectively apply subrogation in Ukraine not only in motor insurance, but also in larger insurance transactions, such as insurance of the supply of complex equipment, machinery, insurance of industrial facilities, and other investment objects.