Financial assistance for Ukrainian subsidiaries in times of crisis

1. Сoronavirus crisis

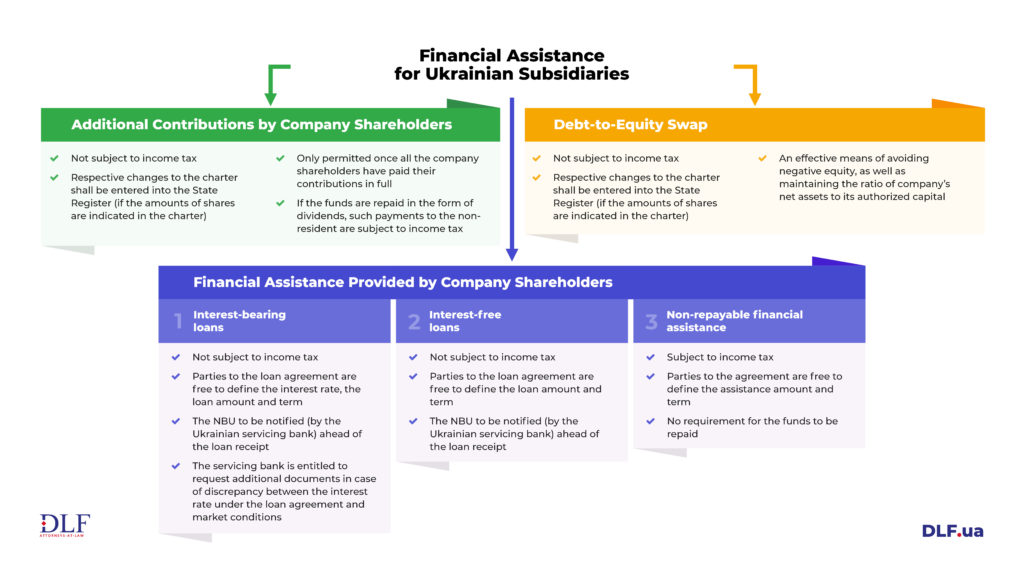

2. Additional contributions made by company shareholders

3. Financial assistance provided by company shareholders

Non-repayable financial assistance

4. Debt-to-equity swap

As a result of the coronavirus crisis, governments in many countries face a difficult choice: economic losses caused by prolonged restrictions or a serious risk of infection spread among citizens placing a burden on the healthcare system. Ukraine, following the lead of many developed countries, introduced restrictive measures aimed primarily at limiting social contacts. These restrictions, in turn, led to a collapse of production, a sharp rise in unemployment, and a significant decrease in sales of both domestic and foreign goods.

Even though the Ukrainian government is trying to mitigate the negative effects of the restrictions imposed on the economy by launching business support programs, such as tax breaks, low-interest loans or temporary tax exemption, sooner or later, many companies will still be in need of additional funding or refinancing their debt. This article will look into some tools that can be used by Ukrainian subsidiaries of foreign companies in this situation to receive financial assistance.

Additional contributions made by company shareholders

Parent company shareholders have the opportunity to provide funding to their subsidiary by making an additional contribution to the subsidiary’s capital. The simplicity of this financing method lies in the fact that there is no need to engage third parties, as well as in the absence of tax consequences. Ukrainian tax law does not consider an increase in the authorized capital through additional contributions made by shareholders as income; therefore, transactions involving additional contributions to the authorized capital of a subsidiary do not affect the taxable income amount.

However, should a shareholder decide to return the paid-in contribution in the form of dividends, such payments to the non-resident shall be subject to income tax.

It should be noted that an increase in the authorized capital of a company through additional contributions is only permitted once all the company shareholders have paid their contributions in full. If the value of the company’s net assets decreases by more than 50% compared to previous year, then the subsidiary should resolve to reduce the authorized capital or liquidate the company.

Funds received by a subsidiary in the form of an additional contribution to the authorized capital may be used by the company to replenish its working capital.

Financial assistance provided by company shareholders

Interest-bearing loans

In order to finance the activities of a subsidiary, the parent company may grant it an interest-bearing loan.

In accordance with the requirements of Ukrainian currency control laws, companies must notify the National Bank of Ukraine of receiving foreign currency loans from foreign companies. Such information shall be provided to the National Bank of Ukraine by the Ukrainian servicing bank of the subsidiary on the basis of the documents furnished by a respective client. However, it should be noted that the National Bank of Ukraine must be notified of the foreign currency transaction prior to the actual receipt of the loan.

The law does not set any limits on the permissible amount and term of the loan. There are also no limitations on the interest rate to be paid on the loan granted by a foreign company. However, a discrepancy between interest rate under the loan agreement and market conditions is considered as a sign of a suspicious transaction, which gives the bank the right to request additional documents from the parties to the agreement so that the bank can check if the nature and amount of the transaction are adequate to the financial condition and activities of the parties to the agreement.

Under Ukrainian tax law, interest-bearing loans shall not be subject to corporate income tax.

Interest-free loans

In order to replenish the working capital, a subsidiary might also opt for receiving the so-called repayable financial assistance from the foreign parent company. Like a usual loan agreement (with interest), an interest-free loan agreement shall be registered by the servicing bank in the information system of the National Bank of Ukraine.

Parties to an interest-free loan agreement, like parties to a usual loan agreement, have the right to determine the loan amount and loan term at their own discretion. The loan amount under the repayable financial assistance agreement shall not be subject to corporate income tax.

Non-repayable financial assistance

Non-repayable financial assistance may be provided for the purpose of financing on the basis of an agreement for provision of such assistance made between a Ukrainian subsidiary and a foreign parent company. Under the agreement, the subsidiary will not be required to repay the funds to the foreign parent company upon receipt of financial assistance.

At the same time, under Ukrainian tax law, the amount of non-repayable financial assistance shall be included in the subsidiary’s income and is therefore subject to corporate income tax.

Debt-to-equity swap

An effective intragroup debt repayment strategy provided by the Law of Ukraine On the Limited Liability Companies and Additional Liability Companies is converting company’s debt into its authorized capital.

In order to avoid negative equity, as well as to maintain the ratio of company’s net assets to its authorized capital, the parent company can, via increasing the authorized capital of the subsidiary, opt for converting the debt owed to it by the subsidiary into a share in the increased authorized capital.

As regards the debt-to-equity swap tax implications, tax authorities currently regard the conversion of debt into equity as not incurring any income tax and value-added tax liabilities for either party.

Conversion of debt into equity of a Ukrainian company is also possible in relation to third-party creditors who, in exchange for offsetting their monetary claims against a Ukrainian debtor, get corporate rights in the authorized capital of the company, and therefore can expect, for example, the debt to be repaid in the form of dividends.

Thus, in view of the decision taken by the Ukrainian government to further extend the lockdown for businesses, as well as the understanding that businesses will need time to resume economic activity, foreign parent companies should be ready in advance to prepare a ‘safety net’ in the form of funding that will help their subsidiaries to calmly go through the crisis.