Agribusiness in Ukraine: financing options

Introduction

1. Bank loans

2. Agricultural receipts

3. Direct investment

4. Issue of securities

5. Leasing

6. Promissory notes

For agribusiness in Ukraine, the issue of financing is a cornerstone of its activities and development. Agricultural production is extremely capital intensive. The proceeds from the product sale depend on many factors and are irregular.

At the same time, there are always costs in agribusiness – a continuous process of land cultivation (farming, fertilization, plant protection product distribution, sowing campaign, harvesting), product storage (grain drying, maintenance of elevators, or storage fees at other people’s elevators), machinery repair, maintenance and fuelling (intensive operation leads to rapid wear of machinery and equipment), significant labor costs (even taking into account seasonal employment).

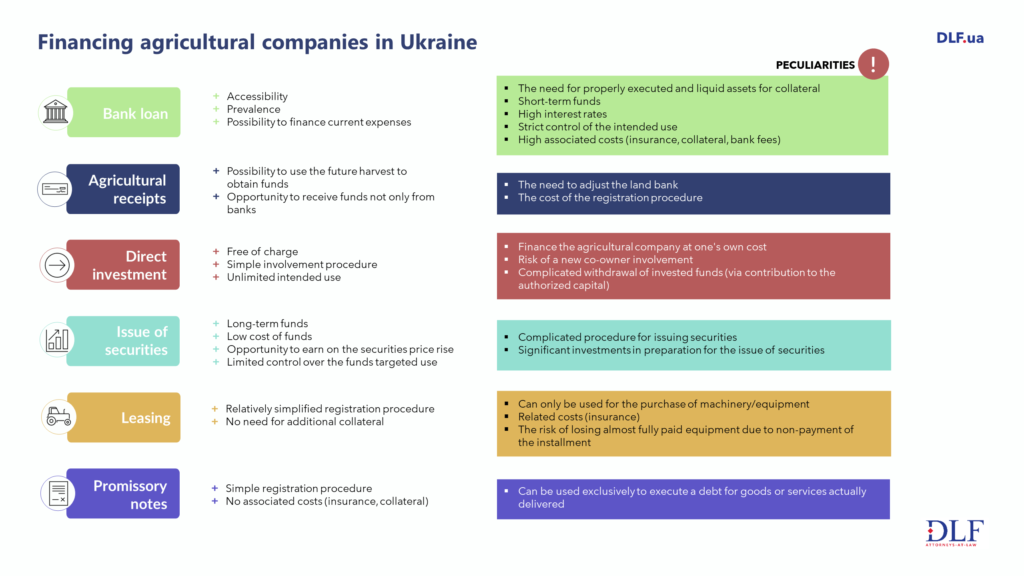

The most accessible sources of financing in Ukraine are bank loans, agricultural receipts, direct investment, issue of securities, leasing, and promissory notes.

(Click on the image for full view)

1. Bank loans

Bank loans are the most common form of agribusiness financing. Mostly, banks issue loans to replenish working capital and cover urgent financial needs: the purchase of plant protection products, seeds, current needs. Typically, such loans are issued in the form of credit lines or overdrafts, less often in the form of loans. It is also traditional to involve bank loans for the implementation of infrastructure projects, purchase of machinery and equipment.

Related article: Partial Loan Guarantee Fund for the Ukrainian agriculture

The basic issue and the main problem in involving bank loans by agricultural companies in Ukraine is the need for sufficient collateral. Agricultural companies that don’t have yet a serious credit history can usually get a loan in exactly the same amount as they will cover it with various types of collateral. This often is complicated for a farmer.

Traditionally, Ukrainian banks trust mostly the collateral of real estate and equipment. It is good if the agricultural company owns a brand new elevator or farm. But often new and liquid objects are built under project financing and already pledged or subject to other restrictions. The vast majority of liquid equipment is also obtained either on credit or on a lease, and cannot be pledged.

Very often most of the agricultural companies’ assets are either illiquid and poorly formalized (tractor crews, elevators, warehouses, granaries, equity), or quickly depreciated (machinery is extremely intensively used), or expensive (plant protection products, grain, seeds). For this reason, agricultural companies in Ukraine often don’t have enough property to secure a bank loan.

The process of obtaining a bank loan includes the borrower check by the bank (audit of financial condition, existing liabilities, property status, the possibility of securing obligations under the loan agreement, credit history), loan and collateral agreements conclusion (collateral, securities, pledges, guarantees), pledged property insurance contracts conclusion.

When using credit funds, the borrower, as a rule, must not only regularly pay interest on the loan but also provide financial statements to the Ukrainian bank, allow the bank to verify the intended use of credit funds and collateral’s condition, use accounts of the bank providing the loan for settlement. The bank may also impose other restrictions and requirements on the agricultural company’s activities during the period of credit funds use.

2. Agricultural receipts

Agricultural receipts are a relatively new tool for financing agricultural producers. But it is agricultural receipts that allow agricultural companies to break the vicious circle of “no collateral – no credit – no possibility to buy a property that can be pledged.” In fact, the future harvest is pledged by agricultural receipts.

The main difference (as well as the advantage) of agricultural receipts: funds provided under the contract can be obtained not only from the bank but also from any person. Moreover, the Ukrainian agricultural company can use its main asset – crops as collateral.

At the same time, agricultural receipts require very effective management of the land bank: control over the registration of leased land plots, management of lease relations. This is because during the registration of the agricultural receipt it is necessary to provide the notary with documents confirming the agricultural company’ right to cultivate the land for crops. In addition, the obligation of notarization makes the procedure for raising funds by an agricultural company through agricultural receipts more expensive.

It is important to remember that if the debtor fails to comply with the terms of the agricultural receipt, the creditor does not need to apply to court. The agricultural receipt in case of the debtor’s obligation failure has the status of an executive document. The creditor may apply directly to the enforcement authorities, in particular to private enforcement agents.

3. Direct investment

Direct investment, as a source of funding, is mainly made in the form of:

- sale of a share in the authorized capital of an agricultural company to an investor;

- increasing the share in the authorized capital of the agricultural company by contributing own funds;

In Ukraine, direct investment can also be less formalized: owners can provide their company with repayable financial assistance. Other people can also provide such assistance. In practice, the provision of financial assistance by the owner is also used to withdraw invested funds faster when there is no more need for them. If the funds are invested in the authorized capital, their withdrawal is accompanied by complex legal procedures (reduction of authorized capital, etc.).

Of course, selling a share of an agricultural company to a new investor is the least attractive way to get financing. But this form exists and is often used not to cover current needs, but to develop the agricultural company. As a general rule, direct investment in this case is an investment that gives the investor an opportunity to control the activities of the Ukrainian agricultural company.

4. Issue of securities

Issue of securities is economically the most profitable source of financing for an agricultural company. However, the process of such financing is complex and expensive.

Fund-raising in financial markets through the placement of securities requires meticulous structuring of assets, involvement of advisers, and relevant institutions, reporting arrangement and significant investment in human resources. In addition, successful fund-raising in the financial markets requires a certain history of success and truly convincing prospects. This source of funding is available primarily to large and well-structured agricultural companies.

It should also be borne in mind that the issue of securities for the Ukrainian market is mostly not very justified. This is due to the rather sluggish securities market of Ukraine. In most cases, Ukrainian agricultural companies raise the funds this way in the markets of Western Europe.

5. Leasing

Leasing is one of the most popular sources of financing the purchase of machinery and equipment by agricultural companies in Ukraine. Agricultural production requires very expensive specialized equipment. Unlike bank loans, leasing is much more flexible, doesn’t require additional collateral, excellent credit history, and long registration. An agricultural company receives the necessary equipment and makes regular payments for it during the period specified in the lease agreement.

The disadvantage of this source of financing is its specialization: leasing financing can be obtained only for the purchase of machinery and equipment. Leasing doesn’t solve problems with financing the agricultural company’s current needs.

It should also be noted that an agricultural company can only use leased property and cannot sell or pledge it. In addition, in case of a lease payment delay for more than 30 days, the lessor has the right to withdraw from the lease agreement and demand the return of the leased asset from the lessee. It is very unpleasant to lose almost fully paid equipment due to temporary financial problems when the agricultural company has already paid most of the lease payments.

A feature of the leasing agreement is the reduction of the property’s purchase price before the expiration of the agreement. This is due to depreciation (annual write-off of the asset’s value part as it depreciates). Depreciation is calculated according to special formulas and doesn’t depend on the actual depreciation of the assets. Accelerated depreciation is used in leasing agreements for certain types of property, due to which by the end of the agreement machinery or equipment have zero value and become the property of the lessee without additional payment.

6. Promissory notes

Promissory notes can be issued only for the execution of a monetary debt for the goods actually delivered (works performed or services rendered). At the time of a promissory note issuance, the promissory note’s payer (for example, a Ukrainian agricultural company) must have an obligation to a seller (for example, a seller of plant protection products) in the amount not less than the amount of the promissory note. The main advantage of a promissory note is that it provides for deferred payment for the period specified in the promissory note. Interest on a promissory note is not a mandatory condition – a promissory note can be issued without paying interest.

Promissory notes allow Ukrainian agricultural companies to wait for high prices for their products. Usually, during the harvest period, prices fall and costs increase. By postponing debt repayment, the agricultural company can make funds available for timely harvesting, drying, and storage, and make more profit due to possible price rallies. In addition, by timely promissory notes’ payment, the agricultural company forms a positive credit history for taking a bank loan easier.