ІТ in Ukraine: figures, opportunities, and challenges

Introduction

1. Rapid and stable dynamics

2. Ukraine is a global center of R&D, outsourcing, and startups

3. Staff shortage in the IT industry

4. Immigration quotas for foreign professionals

5. Taxation

6. Long-term horizons

7. High quality and affordable Internet

IT industry is confidently becoming one of the flagships of Ukraine’s economy and an integral part of its international image. The crisis, which affected the whole world due to the spread of coronavirus infection and led to a significant decline in the Ukrainian and world economies in 2020-2021, didn’t hinder the powerful and dynamic development of the Ukrainian IT sector.

1. Rapid and stable dynamics

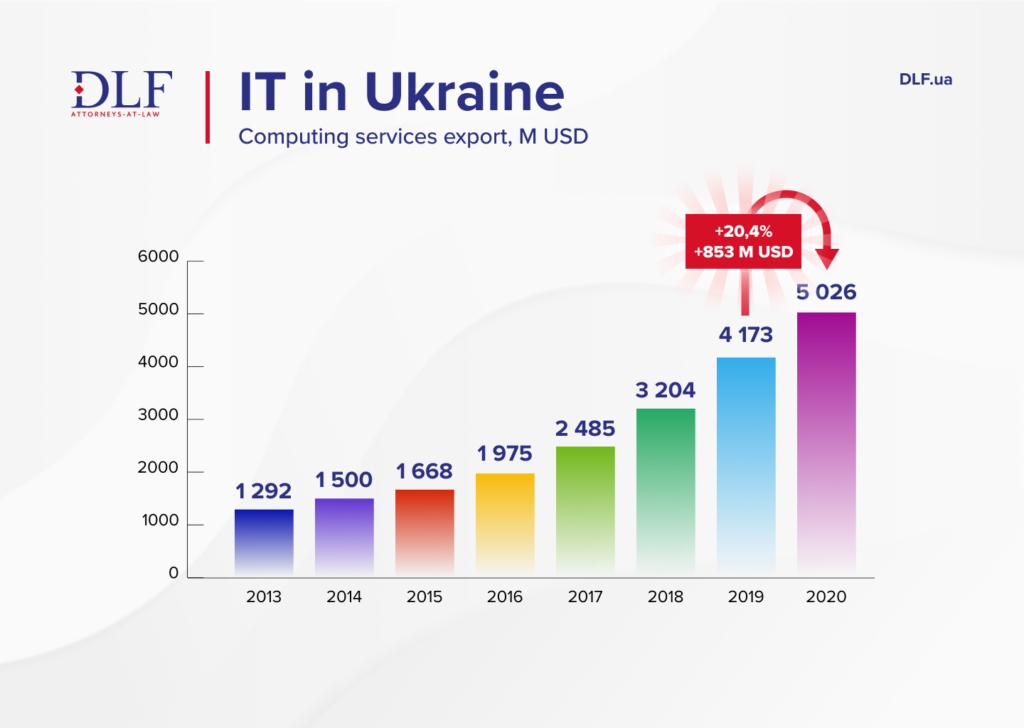

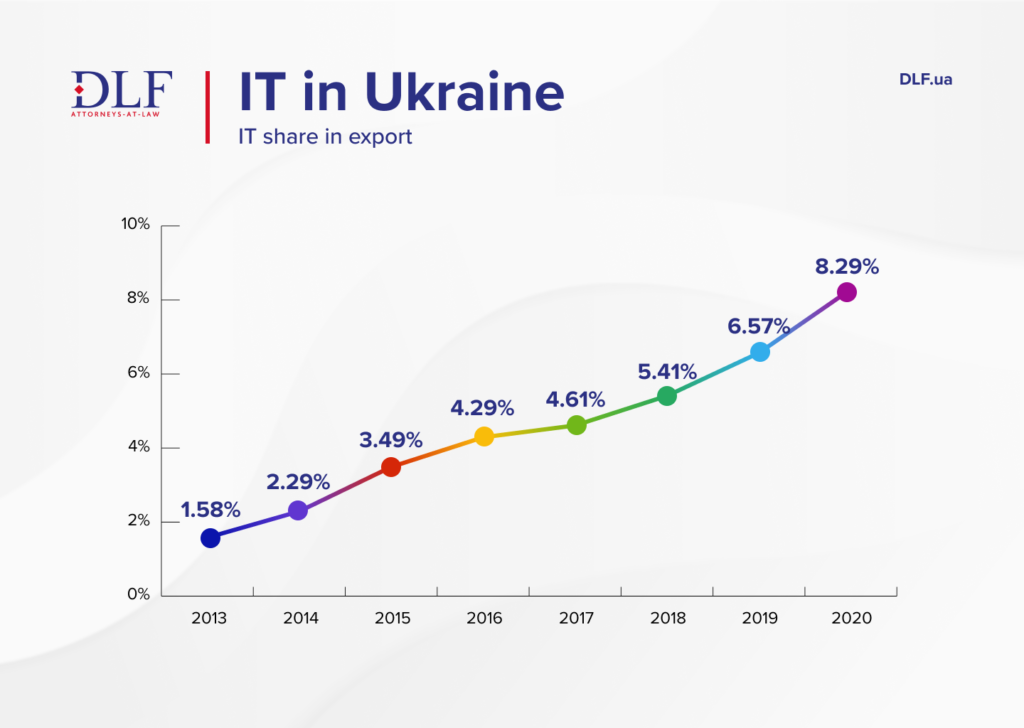

The main positive and significant news for the Ukrainian IT industry in 2020 was the optimistic growth dynamics in exports of Ukrainian IT services. In 2020, for the first time in history, this figure topped the record level of more than USD 5 billion, which was almost 20% (USD 853 million) higher than the same figure of the previous year (USD 4.2 billion). In general, compared to 2013, every year IT industry confidently demonstrates positive dynamics – currently, the IT share in the country’s total export hits 8.3% (1.58% in 2013). Also, IT services export has already outpaced the chemical products export, hit the level of mineral products export, and is close to figures of the metallurgical products export (see Tables below).

(Click on the image for the full view)

(Click on the image for the full view)

All these figures were reached at a time of national GDP fall by -4,2% in 2020 compared to the previous year, as well as a fall in the consolidated index of production of goods and services by main economic activities (CIP) by -4.4% over the same period (all statistical calculations are according to the Ministry of Economy). Other crucial sectors for the Ukrainian economy demonstrate no less eloquent figures for 2020: industry -5.2%, agriculture -11.5%, transport -14.2% (see Table below).

|

Key figures |

Year-on-year change, % |

|||

|

2017 |

2018 | 2019 |

2020 |

|

|

Industry |

1.1 |

3.0 | -0.5 |

-5.2 |

|

Construction |

26.4 | 8.6 | 23.6 |

4.0 |

|

Agriculture |

-2.2 | 8.2 | 1.4 |

-11.5 |

|

Commerce |

3.9 | 4.6 | 3.2 |

4.7 |

|

Transport |

3.6 | 1.5 | 3.1 | -14.2 |

| CIP | 2.8 | 4.3 | 2.6 |

-4.4 |

| GDP | 2.5 | 3.4 | 3.2 |

-4.2 |

(according to the Ministry of Economy)

Growth dynamics is a key factor attracting a lot of attention to the Ukrainian IT industry both within the country and abroad.

2. Ukraine is a global center of R&D, outsourcing, and startups

As per the data collected from various sources by the Beetroot Company and published in their IT industry review, most of the customers in the Ukrainian IT industry are from the United States. After the United States, the services of Ukrainian IT companies are popular in the EU (mostly, in Germany, the Netherlands, and Sweden) and the United Kingdom. Demand among Scandinavian countries, primarily Sweden and Denmark, is expected to grow.

According to the above-mentioned IT market review, more than 100 companies from the Fortune 500 list have chosen the services of Ukrainian IT companies. There are more than a hundred R&D centers of foreign companies in Ukraine, including Google, Samsung, Siemens, and Huawei.

Related: Starting IT-company in Ukraine

In 2020, Ukraine moved up 2 positions in the StartupBlink ranking, reaching the top 30 in the ecosystem development for startups.

Moreover, Ukraine tops the ranking of countries for offshore software development and is gradually becoming a real global IT hub (see the chart below).

(Click on the image for the full view)

3. Staff shortage in the IT industry

Opportunities of the national IT industry are obvious, but the ability of the Ukrainian IT sector to keep pace and the state’s ability to provide the preconditions for this are still debatable. One of the biggest challenges for the future of the IT industry in Ukraine is the acute shortage of staff.

According to GlobalLogic, approximately 40,000 vacancies are opened annually in the country’s IT sector. Every year the demand for engineers in these specialties is growing by 30%, thus the demand for employment of 54,000 new professionals is expected in 2021.

At the same time, the real number of employed engineers is growing by only 18% indicating a significant excess of demand. At the end of 2020, a specialized portal for IT professionals DOU posted more than 10,000 vacancies in the Ukrainian IT market that eloquently demonstrates understaffing.

Ukrainian universities can train no more than 15-20,000 IT specialists in various fields. Furthermore, many graduates prefer to be employed abroad or to be freelancers. IT specialists are also actively trained by numerous private courses, which improves the situation, but still doesn’t cover the significant shortage of IT staff.

Another component of the staff problem in the IT industry is the urgent need for specialists with at least 2-5 years of experience (Middle and Senior level, 37% and 33% of all vacancies in the labor market respectively). Ukrainian universities and training courses can’t solve this problem, no matter how many new specialists they train each year.

4. Immigration quotas for foreign professionals

In the light of severe understaffing, the latest steps of the Ukrainian Government creating massive opportunities for employment of foreign highly qualified IT specialists in Ukraine seem quite logical.

Thus, in 2020, the government introduced for the first time an additional immigration quota for the employment of 5,000 highly qualified foreign IT professionals. Recently, a similar quota was also introduced for 2021 – its number was increased to almost 6,000 people.

The main advantage of employment within the introduced immigration quota is the opportunity to get a permanent residence permit in Ukraine. This means that employment is almost permanent – foreign IT professionals can live and work freely in Ukraine for 10 years, and their employment conditions are no different from the employment conditions of Ukrainian citizens. Also, foreign IT professionals have the priority right to get Ukrainian citizenship and can immigrate to Ukraine with their families.

Last year, the focus of Ukrainian government agencies was on Belarusian IT companies and IT specialists – the Cabinet of Ministers of Ukraine created the most favorable conditions for their activities and employment in Ukraine.

By the Ministry of Digital Transformation, almost 40 Belarusian IT companies with about 2,000 employees have already moved to Ukraine.

5. Taxation

Another fundamentally important issue for the development of the Ukrainian IT sector is tax conditions for the activities of IT companies. The lack of clear and transparent tax rules is one of the factors that hinder the arrival of powerful global players in the Ukrainian IT market.

The rapid development of the domestic IT sphere is mostly stimulated by the possibility of IT specialists’ employment as Private Entrepreneur of the 3rd group with payment of the single tax reduced rate of 5%. The Ukrainian state is not satisfied with this fact, as this group was introduced to stimulate the development of small businesses in Ukraine.

The Ministry of Digital Transformation of Ukraine is trying to find a compromise in this situation by regulating and liberalizing tax relations.

In this regard, the “Diia City” program was initiated for its residents to pay 5% personal income tax and military duty. The relevant bill (number 4303) was registered in the Verkhovna Rada at the end of last year.

The “Diia City” program should become the first virtual business country in the world, within which an accessible, transparent and comprehensive register of business entities in the Ukrainian IT industry will be created for the first time.

It is planned that by 2025 this initiative will create more than 450,000 jobs, and the capitalization of the IT industry will increase by USD 11.8 billion. The program includes, in particular, AgroTech, Fintech and Blockchain, AI and cloud computing technologies, medical neural networks and biotechnology, IoT, Publishing and trading platforms, aerospace technology, drones, advertising, marketing and promotion, animation, graphics and audio, e-sports and business process outsourcing.

6. Long-term horizons

The transformation of the IT-sphere into a strategic sector of the Ukrainian economy is currently one of the principles of the strategic course of the Ministry of Digital Transformation – its volume in the country’s GDP should reach 10%.

To this end, the Ministry of Finance plans a large-scale digitalization of Ukrainian society (100% of public services online).

Another important step is to create the most convenient conditions for the provision of appropriate services by IT companies, and the access to reliable and high-speed Internet plays one of the key roles in this regard (95% of the population should be covered by such Internet).

7. High-quality and affordable Internet

In 2020, according to the Cable.co.uk study (Worldwide Broadband Price Research 2020), only about half of Ukraine’s population has access to the Internet, but on the other hand, Ukraine ranks first in terms of Internet availability (see table below). This creates excellent conditions for both Ukrainian and foreign freelancers.

| Rank | Country | Average cost of broadband (per month in USD) | Average cost of broadband (per megabit per month in USD) | |

| 1 | Ukraine | 6.41 | 0.05 | |

| 2 | Syria | 6.69 | 3.15 | |

| 3 | Russian Federation | 7.50 | 0.10 | |

| 4 | Bhutan | 8.71 | 4.35 | |

| 5 | Sri Lanka | 9.58 | 1.68 | |

| 6 | Iran | 9.60 | 5.46 | |

| 7 | Kazakhstan | 9.76 | 0.69 | |

| 8 | Moldova | 9.95 | 0.18 | |

| 9 | Belarus | 10.11 | 1.14 | |

| 10 | Romania | 10.59 | 0.02 | |

| 11 | Mongolia | 11.13 | 2.97 | |

| 12 | Vietnam | 11.27 | 0.17 | |

| 13 | Turkey | 11.48 | 0.36 | |

| 14 | Tunisia | 11.65 | 0.75 | |

| 15 | Georgia | 12.20 | 1.36 | |

There are many foreign IT companies and entrepreneurs among our clients who understand the advantages of Ukraine. If you are also interested in entering the Ukrainian market, opening an office in Ukraine, relocation, etc., we are always ready to help. Send us a short email at info@DLF.ua or use our contact form.