How can a foreigner buy real estate in Ukraine?

1. The procedure of real estate acquisition

Rights of foreign nationals to acquire real estate in Ukraine

Types of legal transactions

Documents required for the acquisition

Personal presence when concluding the sale and purchase agreement

Granting power of attorneys

Registration procedure

2. Settlements

Payment

Conclusion of agreements with public utility companies. Payment of utility costs

3. Disposal of real estate

Real estate use

Taxes on sale of real estate

4. Real estate taxation in Ukraine

Recurrent taxes on real estate

Taxes on income from real estate

1. The procedure of real estate acquisition

Rights of foreign nationals to acquire real estate in Ukraine

The Ukrainian legislation ensures that foreigners exercise all rights and freedoms as well as obligations under the same conditions as Ukrainian citizens (subject to some exceptions provided for by the laws). Ukrainian laws impose almost no restrictions on the acquisition of real estate in Ukraine by foreigners.

Legal transactions on real estate acquisition in Ukraine may be concluded by foreign nationals who have reached the age of 18. The necessary documents the foreign national has to provide to conclude such legal transactions include foreign national’s international passport or temporary (permanent) residence permit issued in Ukraine and the taxpayer registration number. However, it should be noted that only those foreign nationals who legally stay in Ukraine shall be entitled to acquire real estate. The migration documents issued when the foreign national was crossing the Ukrainian border are considered as proof of the legal stay.

Types of legal transactions

When acquiring real estate, a special consideration must be given to the peculiarities of acquisition of real estate on the primary market (acquisition from the developer or investment in construction) and on the secondary market of real estate (a purchase from the former owner). This, apart from the procedural matters, affects the financial costs to be incurred when concluding a legal transaction.

Additional costs, e.g. relating to the purchase of a new construction apartment (taxes, registration fees, etc.), depend on the structure of the sale proposed by the developer in each particular case. In general, it should be noted that the purchase of a new construction apartment in Ukraine involves certain risks, e.g. availability of developer’s permits or its reputation, which have to be thoroughly analyzed by the lawyers before signing the sale and purchase agreement.

When acquiring the real property in the form of a separate building (such as a cottage), the foreign national may, along with the title to the building, acquire the title to the land plot where the building is located. Foreign nationals may acquire titles to the non-agricultural land plots where the real property in their private ownership is located.

Ukrainian laws do not allow selling agricultural land plots to foreign nationals in Ukraine. If a foreign national inherits an agricultural land plot, he/she has to alienate it within one year.

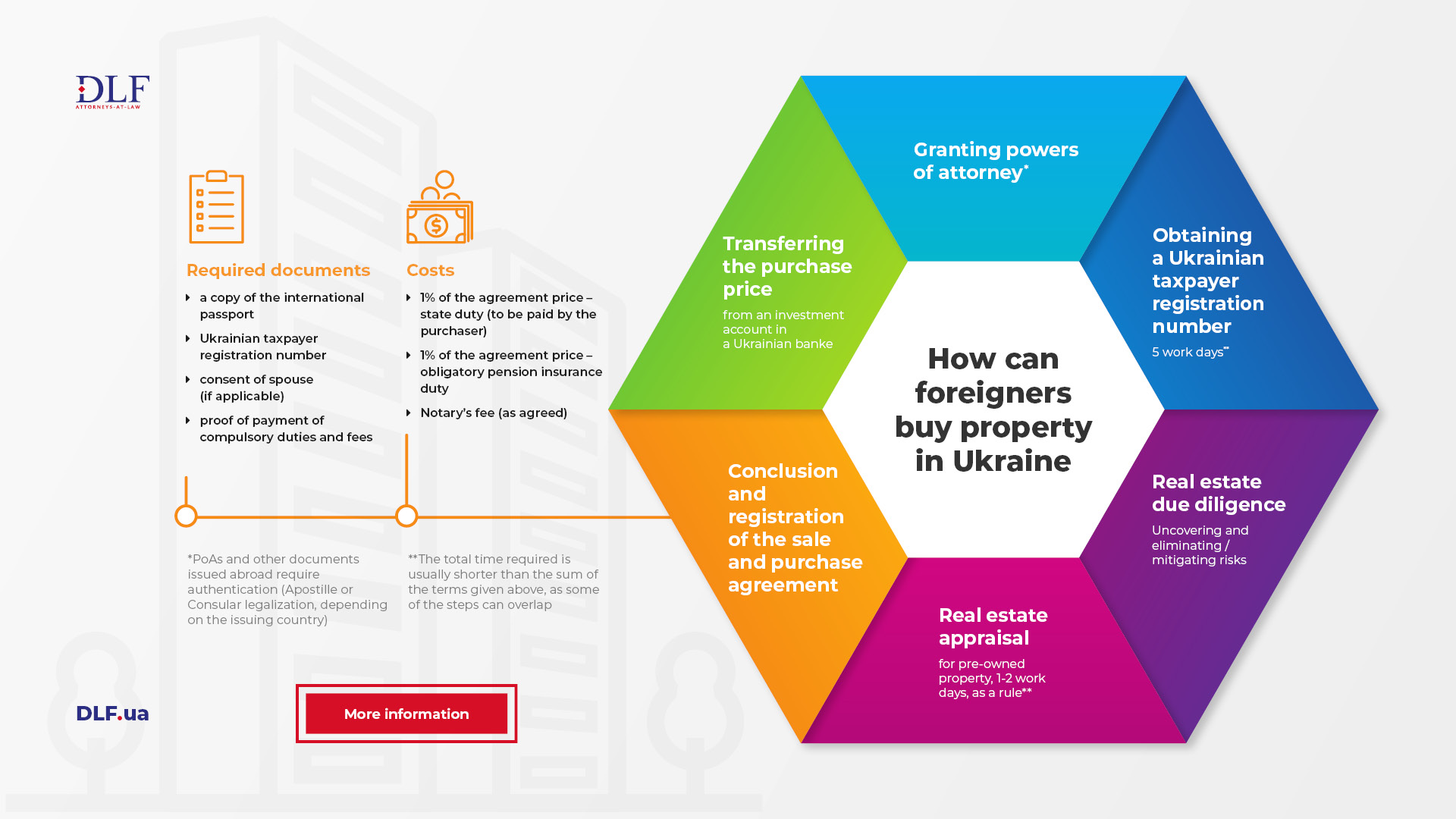

Documents required for the acquisition

In order to acquire real property in Ukraine, the foreign national has to obtain a taxpayer registration number from the Fiscal Service of Ukraine. The procedure for obtaining the registration number is rather simple: submitting to the bodies of the Ukrainian Fiscal Service the application with personal information along with the notarized translation of the foreign national’s passport, which is followed by issuance of the taxpayer registration number within 5 business days. Without the taxpayer registration number, the notary may not register titles to real property in Ukraine. The taxpayer registration number can be obtained without the presence of the foreigner, provided that the foreigner either has an apostilled power of attorney issued abroad, or signs a notarized power of attorney in Ukraine.

When registering a real estate sale and purchase agreement, the foreign national has to submit his/her passport (in case of registering the sale and purchase agreement by an authorized representative, the authorized representative must submit the power of attorney and a copy of the purchaser’s passport) and proof of payment of compulsory duties and fees.

If a foreign national intending to acquire real estate in Ukraine is married, in order to do so, such a foreign national must first obtain the consent of his/her spouse. Such a consent may be given at the notary premises in the case of personal presence of the spouse at the time of concluding the sale and purchase agreement or be submitted as a separate deed in writing certified by the notary and legalized or authenticated with the apostille of the country where such a consent has been given.

Personal presence when concluding the sale and purchase agreement

The conclusion of the sale and purchase agreement and the execution of all necessary payments may be performed by the foreign national in person or by his/her authorized representative on the basis of a power of attorney (for example, a lawyer may take all necessary actions).

Granting power of attorneys

The power of attorney must be certified by a Ukrainian notary or a notary of another country and legalized or authenticated with the apostille.

Registration procedure

The registration of a real estate sale and purchase agreement is performed by the notary. At the time of registration of the sale and purchase agreement, the notary also registers the transfer of the title to the real property. When registering the above mentioned, the notary has to verify payment of all necessary duties and fees, authorization of the parties to conclude the legal transaction, and absence of encumbrances on the real estate.

When registering the real estate sale and purchase agreement, one must also pay a state duty of 1% of the agreement price as well as an obligatory pension insurance duty of 1% of the agreement price. If the Ukrainian seller has owned the real estate for less than 3 years, 5% tax on individual’s income and 1.5% military duty is levied additionally.

2. Settlements

Payment

Since Ukrainian laws restrict the amount of cash payments with individuals to UAH 50,000 (approx. USD 2,040), any payments exceeding this limit shall be effected via bank transfer from a current account or by payment to a current account at the cashier’s desk of a Ukrainian bank. The bank is entitled to refuse payment in cash if the source of such funds or the documents provided do not meet the requirements of Ukrainian laws.

There are several options available to the foreign national when effecting payment of the purchase price of the real property in Ukraine, in particular:

- opening an investment account and transferring to this investment account the foreign currency from abroad;

- direct transferring to the current account of the seller in Ukraine the foreign currency from abroad;

- selling the foreign currency from the investment account and transferring the proceeds in UAH from the sale of the foreign currency to the investment account for further implementing the foreign investment;

- transferring from his/her own investment account funds in UAH and foreign currency to the current account of the resident.

It has to be taken into account when making a cash payment to the current account at the bank cashier’s desk that the upper limit on the undeclared cash that may be brought to Ukraine by individuals amounts to EUR 10,000.

The debiting of funds from the current account of the non-resident opened by another individual (a resident or a non-resident) may be effected only on the basis of a duly certified power of attorney granted by the non-resident.

Conclusion of agreements with public utility companies. Payment of utility costs

Agreements with public utility companies may be concluded by the foreign national in person or by his/her representative.

As some utility costs (such as curtilage maintenance fees or garbage fees) are payable for the maintenance of real estate regardless of whether real property is used or not, the payment of these costs may be assigned to an intermediary. If the foreign national wishes to pay the utility costs on his/her own, he/she has to transfer the funds to a current account in UAH from which the payments shall be effected.

3. Disposal of real estate

Real estate use

The foreign nationals are entitled to dispose of the acquired real estate at their own discretion: to use, to lease, to give as a gift, to exchange, to sell, to pledge, to contribute to the authorized capital and to bequest it.

It should be noted that non-residents (property owners) may not directly lease real property in Ukraine. The lease of real property by a non-resident is only possible though a resident intermediary (a private entrepreneur or a legal entity) in the capacity of a representative of the non-resident on the basis of the written contract, acting as a tax agent of the non-resident for such income.

Taxes on sale of real estate

The income from the sale of real estate owned by the foreign nationals in Ukraine is exempted from taxation if two following conditions are met: the non-resident receives income from the sale of real estate not more than once per tax year and such real estate is owned by the foreign national for more than three years. In all other cases, the income from the sale of real estate is subject to income tax at 18%.

When selling real estate to a non-resident, one also has to pay the military duty of 1.5% and the state duty of 1% of the real estate value specified in the sale and purchase agreement.

4. Real estate taxation in Ukraine

Recurrent taxes on real estate

The taxation of real estate owned by foreign nationals is not different from that of real estate owned by Ukrainian residents.

Real estate is subject to annual tax. The annual tax shall be paid on apartments with a total area of more than 60 sq. m and residential buildings with a total area of more than 120 sq. m as well as on real property of both types with a total area of 180 sq. m.

The tax amount is set depending on the region and shall not exceed 1.5% of the minimum wage (in 2020, the minimum wage amounts to UAH 4,723, approx. USD 190) per square meter which is above the maximum area.

If the foreign national owns residential property with a total area of more than 300 sq. m (for apartments) or an area of more than 500 sq. m (for houses), the tax amount increases up to UAH 25,000 (approx. USD 1,020) per year for each residential property object.

Taxes on income from real estate

The income of non-residents is subject to the same taxation rules and tax rates as that of the residents (with some peculiarities). The general income tax rate (tax on income of individuals) is 18%. The tax amount depends on the rent provided for in the lease agreement; however, it should be at least one minimum rent for a full or partial month.